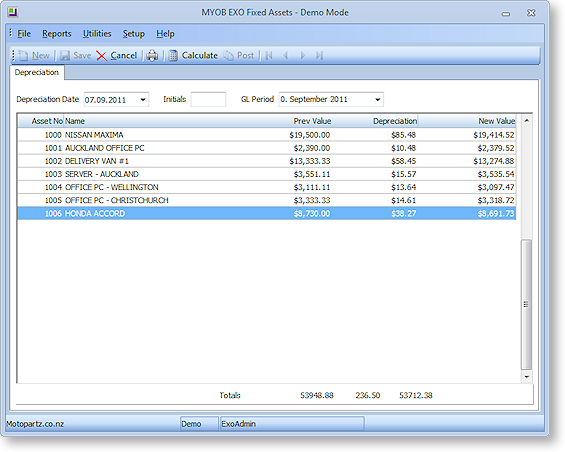

Calculating Depreciation

The main object of depreciation is to spread the original cost of the asset over its expected life. Depreciation is calculated based on the cost price, and debited to expenditure for the applicable accounting period. It is a non-cash transaction.

To calculate asset depreciation:

-

Select Calculate Depreciation from the Utilities menu.

-

The Depreciation tab is displayed. Set the Depreciation Date by selecting the date from the attached calendar.

-

Click the Calculate button.

-

The Depreciation schedule is displayed:

Only those assets that whose Last Depreciation Date is less than the Depreciation Date specified appear. Specify the Accounting Period that you want depreciation expense posted into in the General Ledger. You can also enter your initials as a reference for this depreciation run.

-

Click the Post button to post to the depreciation entry to the General Ledger, and perform the updates in the asset database.

Asset depreciation is calculated automatically, based on the depreciation rates and values that you specify while adding the asset to the register.